CLICK ON IMAGE TO ENLARGE.

CLICK ON IMAGE TO ENLARGE.Fountainbleu Las Vegas Casino Project Pictured Above, is now suing Chase Bank, Bank of America, and others for "bailing out" on their project in midstream.

Fountainebleu apparently secured 800 million in financing and the banks just backed out at the last minute. Construction crews and the manufacturers who supply them are now out of work, thousands of them.

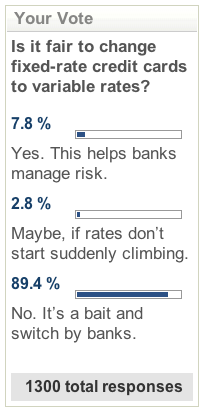

It seems the credit card companies and banks will continue to hammer indentured credit card owners because they are easy, unaligned targets. Why invest in a construction project that creates jobs and stimulates not only the Vegas economy but several construction, manufacturing and service arms all over the country when it is easier to just run roughshod over existing credit card debtors by raising their credit card rates?

Heck, the banks will probably make a handsome profit by not stimulating local economies because that will create more and more families defaulting on credit card loans. Do you see how this works against families, and for the banks?

The banks can make more money in Las Vegas by keeping their own money, the government bailout money, and then waiting out everyone that is going to default on their credit card debt from lack of jobs. As banks starve out these kind of construction projects, it will result in an astronomically huge increase in credit card interest rates from around 8% or 9%, all the way up to 29.99 percent and even higher!

That much of a credit card interest rate spike literally makes credit card debtors indentured for life, causing credit defaults, until the banks just start taking away homeowners homes at pennies on the dollar.

If you don't have credit card debt, this still can affect you as the customers that make your business thrive suddenly are just treading water at 30 percent interest on their credit card debt. Now your customers have to choose between these ridiculous credit card paydown terms or buying something from your business.

As the banks thrive off of 30% credit card interest rate debt they also absorb more property defaults from those who couldn't find employment, just like what is happening in Vegas.

The less the banks do, the more money and property they acquire. Credit Card interest rates should be dropping, now rising, as an incentive to banks to find long term loan deals that make them more money than credit card debt.

It is a myth that credit card companies are losing money from credit card debt, they are creating long term profit by defiling people's credit while also repossessing property.

--------------------------------------------

Help Daily-Protest.com grow by making a Daily-Protest.com sign and posting it where others will see it. You don't have to protest on the streets, just help make others aware that there is a CHASE BANK CREDIT CARD protest going on. Thank you.

No comments:

Post a Comment