What Chase Bank is not saying is that the "one-two percent" that they are blindsiding with a 150% increase in the monthly minimum payment are a million to two million of their most trustworthy, reliable customers who were never late making their payments AND were benefiting from a low interest, life of the loan interest rate!

Chase bank appears to be trying to default their most reliable and trustworthy customers by raising the monthly minimum payment on them by an additional 150% because Chase Bank wins no matter what happens next.What makes the situation completely unacceptable is that Chase Bank is NOT ALLOWING THESE OVER ONE MILLION VICTIMS STRONG to OPT OUT of the change in terms to their pre-existing agreement.

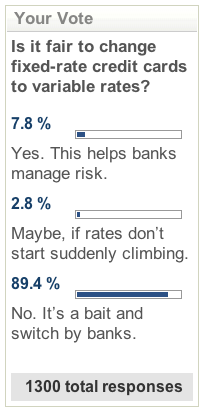

If these one million plus blind sided, previously never late paying Chase Bank customers pay the additional 150% increase in the monthly minimum payment requirement, Chase Bank saves a ton of money by accelerating the pay down on these low interest, life of the loan interest rates, a move that has been aptly labeled bait and switch by an LA Times Headlines.

If these one million Chase Bank customers cannot afford the new 150% higher monthly payment requirement. they will default on the special low interest rate, life of the loan account, the interest rate jumping from 3.99-5.99 percent to as high as 29.99%, and their credit rating will be affected as well.

The other point that NOBODY MAKES is that other credit card companies HAVE NOT raised their monthly minimum payment requirements, and if they do, they will MOST LIKELY OFFER AN OPT OUT OPTION TO THEIR CUSTOMERS, whereas CHASE BANK DID NOT!

If Chase Bank succeeds in raising their monthly minimum payment by 150%, they are basically jumping their payback requirements ahead of all the other banks. This then makes the other banks look bad to their investors and literally forces them to do the same thing. If Chase Bank demands a bigger cut of the monthly minimum payment pie, why shouldn't all the other banking boards do the same thing to customers cannot afford it?

I am actually for higher minimum payments, as long as they are done when someone gets their first credit card, not after they have built up debt under the 2% monthly minimum rule and are using the low interest rate card to pay down that particular bill while paying down higher interest rate cards first, which is EXACTLY how Chase Bank marketed the discount offer to ALL OF THESE CUSTOMERS they are now blind siding.

If Chase Bank succeeds in raising the monthly minimum payment by 150%, consumers will have LESS AVAILABLE MONEY every month to pay other higher interest debts. Chase Bank's demand also suctions much needed money from local economies as people will have absolutely no additional money to spend, even on basic necessisities.

When these consumers credit rating is lowered for defaulting on these Chase bank accounts, they will be paying higher interest rates in the future as well, resulting in less money every month for the local economy.

EVERYBODY is watching to see if Chase Bank succeeds with their "me first, screw everybody else" mind think. Read the consumer affairs dot org link to see how Chase Bank is devastating over a million people come August 2009.http://www.bloggersagainstchasebank.com

No comments:

Post a Comment