As I learn more and more about the credit card industry, I am beginning to find very deceitful articles coming out of the AP.

Either the credit card article is deceitful, or the writer has chosen to simply interview a banking industry "expert" and condense their words into a Public Relations fluff piece while proclaiming it as news.

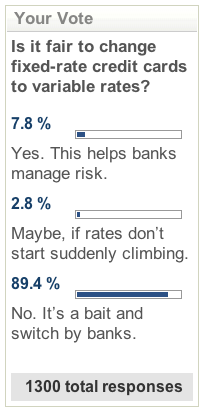

The next time you read that credit card default rates are rising, ask yourself this question, "Is there a relationship between the consumer credit card default rate, and the credit card interest rate"? Of course there is a relationship between the two.

I'll go one step farther. It likely that for each percentage percent the credit card industry raises interest rates, there will be a corresponding rise of AT LEAST one percent in the default rate. So what does that mean? It means the credit card companies are on a self fulfilling prophecy to cause the default rate to rise even as they cry about it and expect sympathy!

This is just nuts!

This means our mainstream media has become so complicit when it comes to reporting financial "noose" around the consumers neck news that all I can say is be thankful that the mainstream media is not the only ones reporting what is happening, (ahem, internet blogs).

The next time you read a "report" about the credit card default rate with no mention of the rise in credit card interest rates as being the direct cause for the default rise, take a moment and reflect on how far our mainstream media has fallen in their quest to expose the real truth behind current financial and economic trends.

No comments:

Post a Comment