Democratic Senator Richard Durbin, I, Alessandro Machi, publicly claim to be a consumer advocate watchdog. Over the years I have done my own form of consumer activism on a very local level. I also was one of the first to out a trust company scam had sales people coming to people's homes to "update trust accounts" but was actually a front that enticed California senior citizens to put their life savings in uninsured accounts.

One of the things I am most proud of is writing every attorney's general in the United States back in 2004 and protesting GM Card changing terms without allowing me to opt out of the change in terms.

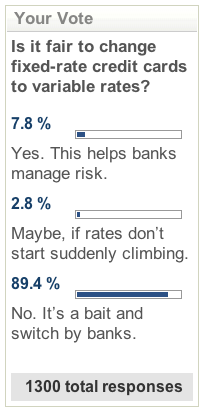

Five years later and this has become one of the biggest issues in regards to credit card companies. My idea back then is only now, five years later, being considered.

Notifying somebody 45 days advance notice that their credit card interest rate is going up becomes irrelevant if the customer is not allowed to stop the change in terms by opting out.

Nor should opting out be cause for the credit industry to lower one's credit score since it is actually represents a consumer being responsible with their credit.

Being responsible when it comes to credit should never lower one's credit score. Creating incentive based credit card programs is something I have been suggesting for the past several days, and it is an idea that I probably am the first to suggest.

No comments:

Post a Comment