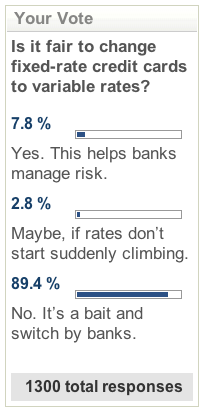

If a credit card company can prove a SIGNIFICANTLY higher default rate based on the types of purchase one makes with their credit card, they may actually reduce that customers credit line. I can understand that line of thought.

The key is to make sure the difference in the default rate is VERY VERY SIGNIFICANT.

I can however blame the credit card companies for raising interest rates on practically all of their customers while not offering any incentive based credit card offers for those who want to lower their debt and have always been good solid customers.

The credit card companies seem bereft in not helping or trusting customers who have shown loyalty and trustworthiness over the years.

No comments:

Post a Comment