Was WAMU taken over by Chase Bank using unethical methods and behind the scenes manipulations, thereby causing WAMU stockholders to lose millions of dollars in shares because the WAMU sale price was sooooo soooo low?

I heard from someone who worked for WAMU that "Chase employees" from Texas started showing up in California WAMU branches months before it was taken over by Chase Bank.

I have a Chase Bank protest blog going as well. http://www.daily-protest.com People are suing Chase Bank from all over the country, not just class action lawsuits but personal lawsuits as well. Many are over the loss of homes and the mishandling of Chase home loans. Chase Bank appears to be rejecting 4 out of every 5 home loan applications, once again, maybe making more money short term by rejecting loans than by approving them.

There are allegations of appraisers either lowballing or highballing a home owners property depending on which way benefits the bank more. Lowballing a value if it means a smaller home equity loan, high balling the value when it causes the loan to be considered more risky

and therefore set at a higher interest rate.

Chase bank appears to be profiting by penalizing and defaulting their customers rather than by actually helping them. I keep hoping the FBI will step in, but with George Bush senior being from Texas and having previously run both the FBI and CIA, am I foolish to believe the FBI will investigate Chase bank and the many things they are doing to harm good honest people when it was Texas Chase people that appear to have infiltrated WAMU Bank and in process causing Wamu stockholders to lose most of their stock share value before it became Chase Bank?

There are no home loan programs currently available for people who have more collateral than the amount of the loan they are requesting, how nutty is that? Our only hope may be to keep posting our complaints on the corporate websites so that eventually people who care may actually step in and do the right thing.

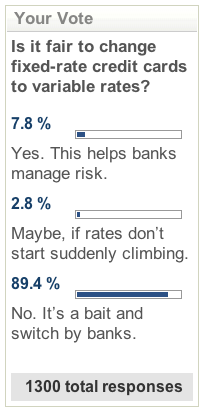

There are NO incentive based credit card debt paydown programs in an economy that is engulfed with nearly a trillion dollars of consumer credit card debt. Why is it acceptable to keep so many people on the hook with old credit card debt AND actually increasing the debt by charging 20-30% interest rates on it! This is just crazy, or perhaps evil is a more appropriate word.

Unsecured consumer credit card debt has actually double or even tripled when it is compared to the overall world wealth over the past couple of years. The world's wealth decreased by perhaps as much as 50%, but consumer credit card debt actually increased, huh??? The interest rate on this older credit card debt continues to rise when it should now be frozen at zero percent for those committted to paying down their older credit card debt.

Interest free consumer credit card paydown programs, especially for debt that is older than three years, would have an positive effect on our economy, and would already be making a difference. I think Bernanke may turn out to be Madoff II as it appears he has no inclination to do anything but the same old thing. daily-protest.com

No comments:

Post a Comment